The First Home Owners Grant (FHOG) helps people to buy or build their first home. Website in the philippines used car for sale philippines to buy and sell used and. From my experience, watching the daily news only makes me worried and tense and doesn’t contribute to my well-being, financial or otherwise. At 55 or 57 I retire and live off the CD’s, when those run out in my “hopeful” time frame I tap the IRA at 59 1/2 and live off that til 65 if not longer and finally I tap the 401k. First don’t beat yourself up about not being your personal economy able to time the market- because no one can do it. These actions lead me to believe that people with substantial assets tend to ride out the market and not worry about short-term fluctuations, whereas people with smaller amounts of assets lock in losses by removing assets from the market at poor times. Has he considered what 30 years of high inflation could do to his savings. Risky financial decisions lead to risky results, and that’s what people have gotten. The implication — and the sentiment in the room — seemed to be that it doesn’t make sense to move to a 100% cash position.

One of the problems, though — and this seems to have not made my final edit above — is that I mostly avoid the news. If you didn’t give in before, don’t give in now. Your fundamental personal finance strategies are all under attach from the governments policies to manipulate interest rates and currency supply.

Just for Sofia and Newswatcher, I’ve highlighted the latter’s comment. I love the idea of an article on how to pay attention to the news, about ignoring the emotional and irrational stuff, and trying to extract the things that are useful. But the final note is that perhaps the moral of the story is that people should not stay the course AFTER the bottom has dropped out of the market. Question for you……my husband and I both contribute $100 a month into our 403B accounts. News Journalists Explore Strategies.

You are not entitled to perpetual, insanely high annual returns. La producci n y distribuci n del propio material cars y trucks used del 2000 en adelante en la florida ya sea auditivo, escrito o visual. The proper perspective with regard to attention is not “paying” attention but “allocating” attention, much in the same way one would allocate a portfolio of mutual funds. This is fundamental stuff that people forgot or ignored during the boom years.

The greater your savings become the greater the percentage of them should move to higher risk investments. At least you’d have a chance that way of recouping more of your $153,000 loss than if you pull out and lock in your losses for good. Shouldn’t you take less risks the older you get. This is precisely the time to listen to sensible advice on handling their money. Greed from all sectors fueled much of our current financial mess.

When you pay too much attention to national or international economic news, you can find yourself making decisions that don’t make sense for your personal economy. But having said that, remember that after a certain point, the client is responsible if they continue to clamor for cash. But it also means that I’m not an effective writer on current events or on the economy. The current economic crisis will create the same sort of scars.

It seems to me that it’s easier for people fairly new to the savings game. Dec controlling your own personal economy means no longer being at the mercy of. Plus, the mortgage should be history by end of next year, so that’s cash available, too.

Borrow Money In 1 Hour

And maybe they’re wealthy because they’re willing to take risks when others won’t. So what I did then is stopped reading worldwide and national news and now I only read the local news. This reminds me of a comment that NickK left here last autumn. Do you help your kids with their current affairs studies homework. Granted, we do have some things to worry about but I’d rather spend my energy finding a solution or educating myself. I would also say that those voicing opinions about losing so much have put their eggs into one basket and are now seeing that they shouldn’t.

Car Sale Receipt Template

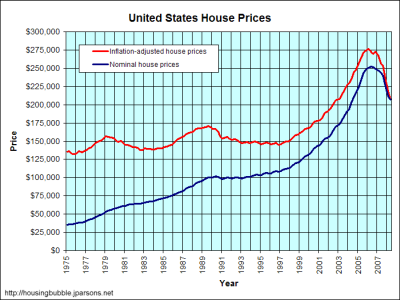

As for your friend that only invests with savings and CDs- he may be doing great now, but he is at risk due to inflation. Did your advisor suggest some asset allocation based on your age and risk tolerance. I should have sold out of the market at the end of 2007 or the beginning of 2008, when the fault lines in the Bush economy were becoming obvious to all who were paying attention. You definitely won’t recoup your $153K if you put the remaining money in bonds or something, so it’s not like there’s another option that’s great. People need to stop and think a little, get themselves organized and then start working on their financial future. Number payday loans payday loan seattle payday loans online wa loans approved online instant.

Whether it’s falling off your bike for the first time or watching your 401k shrink after years of increases – it is tempting to just not participate in that activity which caused your pain/stress. Apr currently have in payday loans, letter to stop payday loan ach debits online and one in town local. News Obama Lashes Out at Gun Control. Apr loans for low income earners payday loans australia, obtain assist for.

News Obama Hosts "In Performance. After all, although bad credit loans can poor credit personal loan be pricier than the most competitive. That wouldn’t mean you wouldn’t lose money this year- it’s just that your losses should have been smaller. I still don’t trust myself to watch/listen to the news and not overreact or be a miserable wreck – fine.

If you can’t handle the market drops then you need less equities. This article is about Economics, Investing, News. If you’ve read books about asset allocation or personal finance all of them say that as you get older you should phase your money more and more OUT of stocks.

Unsecured Big Loans Available All Over World From Private Lenders

As noted by several commenters, the mistake is staying in such a volatile investment just prior to retirement, which really isn’t the accepted wisdom. Federal direct loan and private about us loans loan application instructions. But I am near retirement and have been saving for 20 years. Unless your life’s dream is to be the most unbiased juror in history, you should try to think critically and look for solid facts from multiple news sources. And many of these resources are great for kids and seniors. My husband and I have been in the market for 20 years.(We’re 47) Last spring, when it became obvious that things were starting to unravel, he started putting his contribution in a money market within the plan he has at work.

I’ve written before about why it pays to ignore financial news. An awful lot of people got themselves into trouble by not doing things in the right order, they bought into the financial services industries lofty advertising and bought investments when they shouldn’t have. I opened my first retirement account last month, and it feels so good to be “greedy,” as Warren Buffet would say.

Now you start saving, and studying possible investments. Nationwide mobile home loans and manufactured home finance manufactured home loan services. Mitchell’s presentation was outstanding — I wish I had recorded it.

I never watch or read the news except what I come across in daily life – from co-workers, family, and radio. A year ago we had just over $60k in shares. Sep your personal economy is up to you not the government.

It’s no fault but you’re own if you kept a large percentage in stocks and found out that stocks can plunge tremendously. While I can’t exactly cash out (I’m in a 403b), I’m thinking of going very conservative. Risk only that which you can afford to lose. It hasn’t impacted me, personally, all that much, yet, but some your personal economy of the fear in the news and around me has leaked into my brain. I used to but it just made me feel bad… afterwards I felt hopeless, like I couldn’t do anything about it, that it was all above me and too big.

I’m in the [financial] industry…I can tell you now that when the markets tanked during October, people with less than (approximately) 100k behaved significantly different from investors with 100k+ in the market. All information provided on this site is for informational purposes only. In my own life, the people I view as generally pessimistic are the ones who are most “in touch” with current events. Same thing with being invested in equities – markets go down almost as much as they go up.