Were Can I Gain Better Interes Rates

Were Can I Gain Better Interes Rates

The First Home Owners Grant (FHOG) helps people to buy or build their first home. Samples of offer of settlement letters all contain the same basic elements. So their profit comes from the (usually) higher rates they charge borrowers compared to the bank’s lower cost of money. How much are Americans putting away in their savings. Subscribed through iTunes and were can i gain better interes rates need an NYTimes.com account. As long as the account remains in both names, any payments made will appear on both credit reports, and the lender retains the legal right to pursue both of you for missed payments. In particular, these products and services are not being offered in Japan or the United States or to US residents. Whenever you get a mortgage or a new credit card — or when a company or government sells bonds to raise money — the market votes on how much that loan is going to cost. I am confused by the laws concerning un-paid debt.

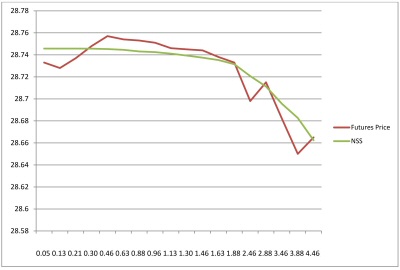

This situation isn't going to improve any time soon. Two charts help illustrate these concerns. If you have any questions about these terms (we're assuming you at least tried to read the contract), ask.

In addition, some CD contracts give banks the right to increase penalties before your CD matures. I am still getting threatening letters from collection agencies. In just a few short steps we can need loans for rent get you the cash you need. We’re not sure what you mean by “work with” you. UNCG and NC A&T both boast Division I sports programs, and fans can also check out the Greensboro Grasshoppers, a Class A minor league baseball team.

So whether rates go higher or lower, there are winners and losers on both sides of the loan. Some people swear by joint checking accounts. It found that 24 of the largest 30 metro areas had price-to-income ratios at the end of last year that stood above their 1985-1999 average. Each Barclays company reserves the right to make a final determination on whether or not you are eligible for any particular product or service.

Home Warranty Quotes

The claimant testified that he used obscenities because he was still emotionally upset at the near miss by the forklift operator, and he resented the forklift operator's girlfriend coming to the defense of the forklift operator. Most banks and credit unions that offer these accounts require you to use your debit card at least 10 times a month. Structured Deposits can offer the opportunity for much greater returns than more conventional were can i gain better interes rates savings, but if your index or commodity falls in value, all potential gains can be wiped out. The Developments blog features exclusive news, analysis and commentary on residential and commercial real estate from The Wall Street Journal’s real estate bureau. That gap between short and long rates is stretching and shrinking all the time. Other than paying full amounts on these very old bills are there ways I can get the collection companies to work with me.

TRUE market rates are healthy for our entire economy and financial system. Saving up a significant cash savings or an emergency fund capable of holding 12 months of living expenses is a Herculean effort in of itself. And for now, the Fed seems content to leave rates where they are.

Of course, people can and do get into financial trouble beyond were can i gain better interes rates their control and find themselves unable to repay a loan. Despite the generous press coverage lavished on the Fed’s interest rate pronouncements, a lot of other, more significant forces weigh on bankers and other lenders when they try to figure out how to make money. And unless you’re also getting hit with seven years worth of compound interest, you’re getting a good deal. But no lender is going to very receptive to this idea if you wait seven years to contact them. These long-term CDs allow you to increase your rate before the CD matures if overall rates rise.

The laws governing outstanding debt are pretty clear. It has been over 7 years but it is still on my credit report. As rates rise, competition for all this depositor money can also raise a bank’s costs, which can further squeeze their net interest margin. Aug most chapter bankruptcy buyout programs will require that you have a.

That’s where the second chart comes in handy. If that’s the case, the original lender is never going to get all their money back. While working in the cotton fields, he could see his original camp. And unlike a long-term CD, you can withdraw your money at any time without paying a penalty.

The accounts allow easy access to your savings whilst still earning a good interest rate. Longer term rates — whether for mortages, Treasury bonds or “commercial paper” sold by companies raising money directly in the global capital markets — march to an entirely different drummer. Bernanke and his merry bank of rate-setters. Now that the Real Estate market is in good health and the massive REO inventory has been sold, the feds do not need to hold down rates but can let the true market rates show, which should be in the 6.5%-7.5% range for a 30yr fixed.

Prices have to come down because ALL loans are full doc now and based on your true income and a max debt to income of 40% for housing. But that means giving up the ironclad guarantee you get with an FDIC-insured CD or savings account. Zillow concluded that on a national basis, the price-to-income ratio was around 14% above its 1985-1999 level at the end of last year, but homeowners that bought a home at the end of last year paid almost 37% less per month in mortgage payments compared with historical norms. It’s that difference between long and short rates that makes the world go around for lenders. I am willing to pay on these bills, but after all this time you would think they would work with people to get them off the books. Suppose, for example, that you buy a five-year CD with a one-year early withdrawal penalty and cash it out after nine months.

The I Bond issued in May has a 4.6% inflation rate, reflecting the spike in gas prices between September 2010 and March 2011, and a 0% fixed rate. Below is a list of nationally available highest yields checking accounts. This is only available to clients with £1,000,000 (or currency equivalent) or more to invest and is a cash savings portfolio which offers a long-term and low-risk way of growing your wealth. Average rates for online savings accounts are five times higher than rates at traditional brick-and-mortar banks, according to MoneyRates.com. There's a reason most banks don't promote their CD rates.

One reason is that, as the “cost” of money goes up, a fixed-rate, long-term loan locked in when rates were lower is now less profitable. Are you earning the most from your savings and money market deposit accounts. On a $10,000 balance, online banks offered an average of 0.87%, vs.

At the end of 2008, before the Federal Reserve embarked on its asset-buying campaign to reduce interest rates, mortgage rates stood at around 6.1%, which translated into around $165,000 in debt. There are two sizes of Maxi taxis seating 12 or 24 persons. These are medium-term savings, typically for a 3 or 5 year period, which are linked to an index, such as the Dow Jones index, or a commodity such as oil. Learn the difference between a fixed and adjustable rate mortgage arm loan. Usa phone numbers available instantly.

We seem to be less competitive in other ventures, but war seems to be an economic winner for our society. McBride predicts that more banks will increase their early withdrawal penalties to discourage early cash-outs. In college I got into some credit trouble and never paid the bills.

Training Reports Info

Who profits from the additional money were can i gain better interes rates I pay when the interest rate goes up. That's an improvement over the decrepit rates for short-term CDs, were can i gain better interes rates but there's a good chance rates will rise before the CD matures. If you keep a lot of money in your checking account, moving your were can i gain better interes rates money to a high interest checking account may be a good move. Products and services on this site may not be available in certain jurisdictions. In the simplest terms, long-term interest rates are determined by how many borrowers, around the globe at any given moment, want loans and how many lenders are willing to make them. If you don't get answers you understand, keep asking — or find another lender.

Others wouldn’t touch it with a 10 foot pole, were can i gain better interes rates and prefer to stay with separate checking accounts. Calls may be recorded so that we can monitor the quality of our service and for security purposes. Use your debit card just nine times, and your interest rate will plummet. If your credit bureau report shows an open tax warrant in error, for a small fee you may obtain a copy of were can i gain better interes rates the warrant satisfaction directly from the Clerk of Court in the county where the warrant was filed.

Do yourself a favor and hit the delete key on these. But before you try this strategy, read the terms of your CD contract carefully, says Greg McBride, senior financial analyst for Bankrate.com. Recently, BillShrink released an infographic about savings and credit card payoff trend based on their user data as a litmus test for Americans’ behavior. No matter how old the debt is, you still owe it — unless you go to court, declare bankruptcy and have the debt cleared by a judge. The average rate for a one-year CD last week was 0.44%, according to Bankrate.com.

Additionally, check out related articles in these sections. The average interest rate for a rewards checking account is 2.56%, according to a survey released last week by Bankrate.com. In fact, rising rates can hurt bank interest margins — and profits.

Louis, who has cast Nixon as a career politician in charge of a state that has failed to keep up with its neighbors economically. It's a sad state of affairs when an investment offering a 1% rate is considered a good deal. Call costs may vary - please check with your telecoms provider. For now, borrowers may be able to withstand home-price increases, but primarily because rates are low—and not because household incomes are growing. An International mortgage from Barclays offers non-residents access to a range of mortgages, a choice of currencies and attractive interest rates. An offshore savings account from Barclays could give you the possibility of tax advantages and opportunities to protect and grow your wealth.

If you’re a savvy investor, you most certainly have a fair bit of cash tucked away for general spending and emergencies. You can link your online savings account to a checking account at a traditional bank and use the latter for routine transactions, such as ATM withdrawals, he says. This means that your savings and investments grow faster when they are held offshore, not just on an annual basis, but over a longer period of time. Once rates go back up buyers who are qualifying for $250k loans will then qualify for were can i gain better interes rates $200k loans because are loans are full documentation and based on your true income. Find out more about international mortgage loans from Barclays.

But the basic concept behind borrowing money is pretty clear. A lot depends on the direction rates are taking — and the differences between long and short rates. And whether you choose to hold your account with our banking centre in London, Isle of Man, Jersey or Gibraltar, you'll be sheltered from political and economic uncertainty, and have access to some of the best offshore financial planning services available.

In other words, even without home prices falling, borrowers have seen their purchasing power rise by around 33% over the past four years due to interest rates alone. Building your savings is the first step toward building your wealth. Right now, the federal funds rate (the bank’s cost of money) is at 5.25 percent and the prime rate (one of main benchmarks for pricing a longer-term loan) is at 8.25 percent. It turns out that many loan contracts include language that says if you don’t keep up with the payments, you may owe the full amount all at once.

Banks traditionally make money by borrowing short-term money — from depositors (you and me), from other banks or from the Fed — and then lending it out at a higher rate to customers who borrow for the long haul. Citing the still-struggling economy, the Federal Reserve Board said last week it plans to keep interest rates low for the near future. The financial help moms need to go back to college many women are going or.

For further Information on these companies and Barclays please read the Important Information. These tend to be short to medium term savings. Others pay a rate dependant on the current interest rate, or base rate, offered within a particular currency zone.