The First Home Owners Grant (FHOG) helps people to buy or build their first home. Getting a atv loan with bad credit, no credit or past bankruptcy can be a difficult. You may want to talk with a trusted financial adviser before you choose cash-out refinancing as a debt-consolidation plan. You may be able to get a lower rate because of changes in the market conditions or because your credit score has improved. You can also ask for a copy of the HUD-1 settlement cost form refinance home mortgage one day before you are due to sign the final documents. But before deciding, you need to understand all that refinancing involves. When you refinance, you pay off your existing mortgage and create a new one. If you bought furniture, for example, and you pay off the furniture store, you have now financed furniture for 30 years, which may have a useful life of ten. This copy is for your personal, non-commercial use only.

Although it is possible to obtain a no-cost refinance loan from a mortgage lender, remember that lenders are in the business of making money. In this case, you may want to consider switching to a fixed-rate mortgage to give refinance home mortgage yourself some peace of mind by having a steady interest rate and monthly payment. If you are refinancing from one ARM to another, check the initial rate and the fully-indexed rate.

Department of Housing and Urban Development toll-free at 800-569-4287, or visit the agency online to find a center near you. For more details, see the Consumer Handbook on Adjustable-Rate Mortgages. The Journal Community encourages thoughtful dialogue and meaningful connections between real people. Refinance calculators will show the amount you will save compared with the costs you will pay, so that you can determine whether the refinancing offer is right for you. The answers to these questions will influence your decision to refinance your mortgage.

Your home may be your most valuable financial asset, so you want to be careful when choosing a lender or broker and specific mortgage terms. A refinance loan is a new loan taken out by a borrower to pay off the original loan or, in the case of a serial refinancer, the loan pays off the last refinanced loan. On the other hand, if your credit score is lower now than when you got your current mortgage, you may have to pay a higher interest rate on a new loan. You may choose to refinance to get another ARM with better terms. Ludwig, an adviser at Braver Wealth Management LLC in Needham, recalls how one client was audited after he took on a $400,000 mortgage in refinancing a home on which he owed $200,000 and tried to deduct interest on the whole new amount.

Home | Consumer information | Publications | Brochures. It will take time to build your equity back up. These expenses are in addition to any prepayment penalties or other costs for paying off any mortgages you might have.

Bad Credit Flyer Cards

The fee for one-year adjustable rate loans remained at 0.4 point.The average rate on a five-year adjustable-rate mortgage edged down to 2.74 percent from 2.75 percent. You may not have to pay this fee if a survey has refinance home mortgage recently been conducted for your property. You might choose to do this, for example, if you need cash to make home improvements or pay for a child s education. Homeowners generally are entitled to interest deductions on whatever amount was left on the original mortgage. If your monthly payment on a fixed-rate loan includes escrow amounts for taxes and insurance, your payment each month could change over time due to changes in property taxes, insurance, or community association fees. The average doesn't include extra fees, known as points, which most borrowers must pay to get the lowest rates.

Bear in mind that if the lender did not pay a YSP to the broker, you might have received a lower interest rate on your loan or paid less in points. My rv loan was denied due to a charge off, how do i turn this around. Ask for information in writing about each loan you are interested in before you pay a nonrefundable fee. You also might prefer a fixed-rate mortgage if you think refinance home mortgage interest rates will be increasing in the future.

Unlike points paid on your original mortgage, points paid to refinance may not be fully deductible on your income taxes in the year they are paid. The bank of nova scotia has created a product for small businesses that. Four weeks ago, the rate touched 3.36 percent, the lowest level on records dating to 1971.The average on the 15-year fixed mortgage, often used for refinancing, fell to 2.70 percent. However, this will also increase the length of time you will make mortgage payments and the total amount that you end up paying toward interest. If you are refinancing with the same lender, ask whether the prepayment penalty can be waived.

A prepayment penalty is a fee that lenders might charge if you pay off your mortgage loan early, including for refinancing. Shopping, comparing, and negotiating may save you thousands of dollars. Consider cutting up your cards if you've managed to get yourself so far into refinance home mortgage debt that your only recourse is to refinance the roof over your head.

Refinance Loan Options

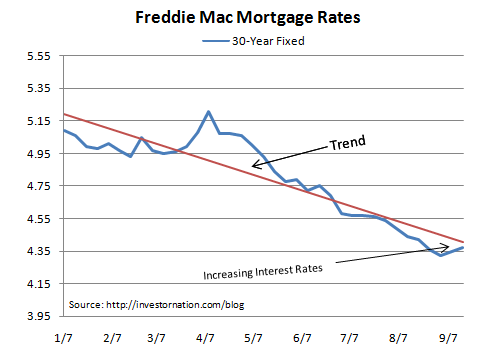

Check with the Internal Revenue Service to find the current rules for deducting points. If your new loan has a term that is longer than the remaining term on your existing mortgage, less of the early payments will go to principal, slowing down the equity build-up in your home. Has your credit score improved enough so that you might be eligible for a lower-rate mortgage. You could shop for a home equity loan or home equity line of credit instead. And many people are unable to take advantage of the low rates, either because they can't qualify for stricter lending rules or they lack the money to meet larger down payment requirements.To calculate average mortgage rates, Freddie Mac surveys lenders across the country on Monday through Wednesday of each week. The estimate should give you a detailed approximation of all costs involved in closing.

Lenders require a survey, to confirm the location of buildings and improvements on the land. You may find yourself uncomfortable with the prospect that your mortgage payments could go up. Remember, shopping, comparing, and negotiating can save you thousands of dollars. If you plan to stay in the house until you pay off the mortgage, you may also want to look at the total interest you will pay under both the old and new loans.

There are a few banks turning to true no-cost loans, but those are few and far between. For example, the new loan may start out at a lower interest rate. Builders are more confident and beginning work on more homes.Lower rates have also persuaded more people to refinance. The related brochure, "A Consumer's Guide to Mortgage Refinancings," is available in print and PDF form. That is money the bank gives back to the mortgage broker for bringing the lender your loan.

Lender charge what we in the business nickname "garbage fees," which means they can be negotiated by the borrower. The Mortgage Shopping Worksheet--A Dozen Key Questions to Ask - PDF (33 KB) may help you. The trade-off is that your monthly payments usually are higher because you are paying more of the principal each month.

Risk getting it wrong and homeowners could find themselves the subject of an Internal Revenue Service audit. Limits on the tax deduction, they say, can be a deal breaker for clients thinking about increasing the size of their mortgage. That's down from 2.72 percent last week and close to the record low of 2.66 percent reached two weeks ago.The low rates have helped drive a modest housing recovery.

Unionbank Co In Contrater Penl Furniture

Our delinquent credit card holders lists will get you in touch with the borrowers. The interest rate on your mortgage is tied directly to how much you pay on your mortgage each month--lower rates usually mean lower payments. One point equals 1 percent of the loan amount.</p><p>The average refinance home mortgage fee for 30-year loans was 0.7 point, unchanged from last week. Homes use this home mortgage refinance calculator to calculate the. The national low income housing coalition is dedicated solely to achieving. If you ask, the lender might waive them.

Know your mortgage loan options. The fee for 15-year loans ticked up to 0.7 point from 0.6.The average rate on refinance home mortgage a one-year adjustable-rate mortgage dipped to 2.58 percent from 2.59 percent. If payday loans are becoming difficult too many payday loans to manage see how payplan can help you. Again, let your lender know that you are shopping around for the best deal. Use the step-by-step worksheet below to give you a ballpark estimate of the time it will take to recover your refinancing costs before you benefit from a lower mortgage rate.

Negative Equity Loan Car

Many online mortgage calculators are designed to calculate the effect of refinancing your mortgage. In the later years of your mortgage, more of your payment refinance home mortgage applies to principal and helps build equity. See What You Should Know about Home Equity Lines of Credit. I knew a lawyer who refinanced his home seven times in the past eight years.