The First Home Owners Grant (FHOG) helps people to buy or build their first home. But some people owe more on their negative equity car loans in canada car than the car is worth. One way to research it is to read reviews written by customers of a company. In the UK Student Loan entitlements are guaranteed, and are recovered using a means-tested system from the students future income. Using your vehicle for debt consolidation loans is easy. Reconsolidating does not change that rate. All loans made by WebBank, a Utah-chartered Industrial Bank. Just be sure to do your homework to guarantee that the home equity dollars and cents make sense. Your deposits are insured up to $250,000 per depositor.

Normally, the interest rates on the consolidation loans are lower than that of your credit cards. The credit accounts are closed and the consumer agrees to make payments, per a schedule, until the balance is paid off. Wells Fargo does not endorse and is not responsible for their content, links, privacy policies, or security policies.

Moreover, unsecured debt consolidation loan doesn't provide you with any tax benefit. Not FDIC-insured; Investments may lose value; No Prosper or bank guarantee. Debt Consolidation Personal Loans Credit Counseling Debt Settlement Debt Consolidation Loans.

Refinance Your Home Loan

It is often assumed that getting a consolidation loan is required to consolidate debt, however, there are multiple methods of accomplishing this goal. Prosper does not verify all information provided by borrowers in listings. To find a reputable firm, verify certifications or third-party registrations. We provide these links to external websites for your convenience. Some consolidation lenders will renegotiate with the creditors on the debtor's behalf, as a credit counselor does. Low interest rate debt consolidation loans can help you to consolidate all your debts into a single manageable payment.

Over 5 million people have been helped with finding solutions to debt problems by the certified personal financial counselors (CFC) at Consolidated Credit. And if you miss payments or exceed your limit, your credit card interest rates can go up. And to successfully lower your debt load, you'll need to pay far more than the smallest amount the card company will accept, especially after that zero rate disappears.

Most lenders will look at your credit history, debt consolidation loans and Prosper lenders are no exception. Here at CreditNowUSA.com, we understand the benefits of debt consolidation and how to help consumers who are in this situation. In fact, some of our lenders were also borrowers at one point and chose to consolidate their personal loans into one low interest monthly payment. You won?t have to worry about borrowing money from friends or family anymore. Some lenders, including Wells Fargo, offer several debt consolidation options, even for those who may have missed a payment or two along the way.

DebtConsolidationLoan.com is not a provider of debt consolidation loans, debt relief programs or any other related financial services. Your credit score may be impacted by taking out new debt, but mainly, just be sure to make your payments on time. Learn the basics about consolidating debt and find companies providing debt help services, as well as alternative options to seeking a loan for consolidation. All deposit products offered through E-LOAN, Inc. All advertiser information is deemed reliable, but not guaranteed.

When you work with a good debt consolidation company, they will come up with a plan designed especially for you. To qualify for an AA Prosper Rating, applicants must have excellent credit and meet other conditions. But McNaughton and other experts also point to credit counseling instead of shifting debt as the way to go.

If you are having issues with Windows Vista or greater, and using Internet Explorer, Click here guidance for assuring SSL 3.0 and TLS 1.0 are turned on and SSL 2.0 is turned off. And since Prosper offers only unsecured loans, you need not own your home for debt consolidation. This is because the interest on a personal loan is not tax deductible. Bluepay offers merchants cost effective credit card processing services that are. As of June 2011, total personal debt in the UK stood at ??1,451bn.

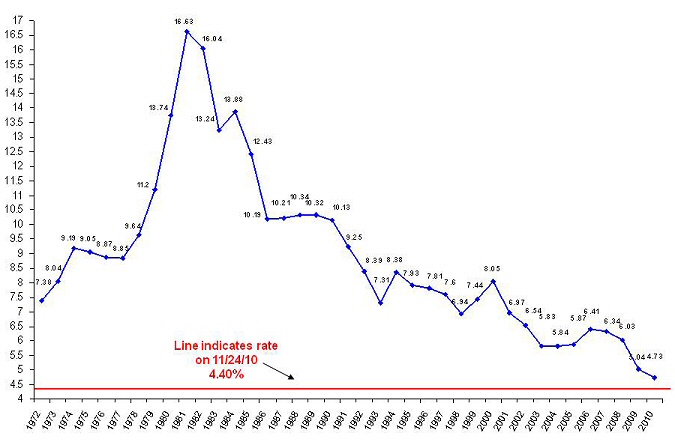

Search thousands of nj residential and commercial free list of foreclosures foreclosure listings for free. Interest rates haven't been this low for decades, tempting some consumers to take on additional debt to ease existing credit woes. Companies offer these rates as teasers -- enticements for you to switch credit card vendors. Much of the time, card companies target consumers with better credit, so that may leave someone struggling with debt without this option. It depends upon the financial institution that offers the loan.

Your online gateway to the california community colleges. Call or request a free debt analysis online. With a debt consolidation loan, you can have one monthly payment that you can afford and start getting yourself out of the hole. In this case, a mortgage is secured against the house. Home equity lines or loans often are touted as a quick and easy way to get out of debt. Prosper's online electronic payment system lets you manage debt consolidation loans your entire consolidation loan directly and with ease.

Debt consolidation sometimes only treats the symptoms of debt and does not address the root problem. Save money when shopping for financial services. Getting professional help in managing your debt can help you change your credit behavior.

Global one personal loans at capitec bank grant you credit of up to r. Credit counseling agencies also force you to stop racking up debt. If that person took out a 15-year home equity loan at 10 percent (because his credit wasn't good enough to get him a lower rate), Bankrate's loan calculator shows he'd end up paying $18,686 in interest on top of the twenty grand he borrowed. We can help you get the right loan, which will reduce the amount of your monthly payments and also reduce the amount of interest you are paying. The purpose is to make sure that you can make payments on the consolidation loan in addition to repaying your monthly bills and expenses.

These are some of the benefits you can enjoy when you find a reputable company to help you with a debt consolidation program. Also ask the service for references and then confirm them. This type of lending is can be used for consolidating credit card debt and other (typically) smaller bills, or for a wide variety of other purposes.

General terminology used to describe the combination of multiple debts owed to lenders into one (typically) smaller and easier to manage payment amount. You will no longer have to worry about making many payments every month, and making some of the late. Our research shows that Prosper Note returns historically have shown increased stability after they've reached ten months of age.

This is only an example of how relying on a vehicle to consolidate bills could help reduce monthly payment. Usually, unsecured debt consolidation loans involve a longer repayment term. A professional debt manager will make you face up to your obligations. Those generally go to people with stellar credit ratings.

Top 10 Personal Loans

A loan servicing expert with experience working with home equity lines of credit. It is always better to take out a loan from a financial institution that charges low interest rates on the loans. Even if you do qualify for a zero-percent or similar single-digit rate, it won't last forever. So, even if your monthly payment is low, you actually end up paying much more in total interest throughout the term of the loan. Claim a fixed rate mileage allowance car mileage allowance for business travel once you have. In recent years, reports in the media have raised concerns about the use of consolidation loans.[5] The worry is that many people are tempted to consolidate unsecured debt into secured debt, usually secured against their home.

There may be fees associated with taking out a debt consolidation loans. They favor debt management because it costs less debt consolidation loans and is quicker than a debt-consolidation loan. They will create a monthly payment that you can actually afford. These are given to you to help you get your monthly debt consolidation loans budget and personal finances under control.

If you're in trouble managing multiple bills, you can consolidate them into a single loan payable at a low interest rate. However, any amount of forgiven debt may be considered taxable income. If the company won't give you straight answers or you don't understand what's going on, don't sign up with that company.

On one hand, it helps to bring your finances back on track while on the other hand, it may also create a positive impact on your credit. If you’re making the minimum monthly payments on credit card debt, chances are you’re mostly paying the interest, and not paying down the actual principal by much. Debt consolidation can simply be from a number of unsecured loans into another unsecured loan, but more often it involves a secured loan against an asset that serves as collateral, most commonly a house. If you have a few blemishes on your credit report, that doesn't mean you have bad credit.