The First Home Owners Grant (FHOG) helps people to buy or build their first home. Employee letter and email examples for hiring, termination, promotions, missing. Targeting shortcomings of HARP 2.0 (the enhanced version of the Home Affordable Refinance Program), the legislation, if passed into law, would. The borrower must have signed for the loan prior to June 1, 2009 and must be current on their mortgage payments with no late payments for the last six months, prior to applying. FHA program originated during the Great Depression of the 1930s, when the rates of foreclosures and conf fixed 20 refi fastrack defaults rose sharply, and the program was intended to provide lenders with sufficient insurance. Tim Manni Tim Manni is the Managing Editor of HSH.com and the author of their daily blog, which concentrates on the latest developments in the mortgage and housing markets. All else said, I’m just glad there’s finally some variety in the market. Fixed-period ARMs -- 30/3/1, 30/5/1, 30/7/1 and 30/10/1 -- are generally tied to the one-year Treasury securities index. Quick Guide to VA Home Loans General brief information about VA Home Loans.

Our 30-plus years of experience in the mortgage industry gives us an edge as we break down the latest changes in an ever-changing market. Fannie Mae and Freddie Mac announces new loan limits every year. The program has since this time been modified to accommodate the heightened recession.

FHA loans have lower down payment requirements and are easier to qualify than conventional loans. The margins remain fixed for the term of the loan and are not impacted conf fixed 20 refi fastrack by the financial markets and movement of interest rates. If you are looking for a jumbo loan and need more information or advice, we invite you to take advantage of our database of the most competitive lenders available. Balloon loans are short-term fixed rate loans that have fixed monthly payments based usually upon a 30-year fully amortizing schedule and a lump sum payment at the end of its term. You must be logged in to post a comment.

You will need to prepay the difference in payments between the 6% and 8% rates the first year, and between the 7% and 8% rates the second year. The conversion is typically done for a nominal fee and requires almost no paperwork. Financial calculators additional services the equity builder mortgage builds.

A Two-Step Mortgage will give you a lower interest rate than a 30-year mortgage for the first five or seven years. The greater the rate of increase or the longer the period of increase, the lower the mortgage payments in the early years. From capital conservation and greater financial truck fleet leasing flexibility to savings on rental tax. Every since the 1930’s Mortgages were a racket.

Mortgage are still a racket established by the. With the traditional 30-year fixed rate mortgage your monthly conf fixed 20 refi fastrack payments are lower than they would be on a shorter term loan. The original principal balance of a mortgage must not exceed the maximum loan limit for the specific area in which the mortgaged premises is located.

The only difference is that your income must be sufficient to cover the higher payment. The interest rate on the new loan is a current rate at the time of conversion. I was skeptical of a 20 year because of the increase in monthly payment but I am pleased that we asked. While your monthly payments are likely to rise if you refinance from a 30-year loan to a 20-year loan, historically-low mortgage rates have made shorter-term home loans much more affordable. Conforming loans have terms and conditions that follow the conf fixed 20 refi fastrack guidelines set forth by Fannie Mae and Freddie Mac.

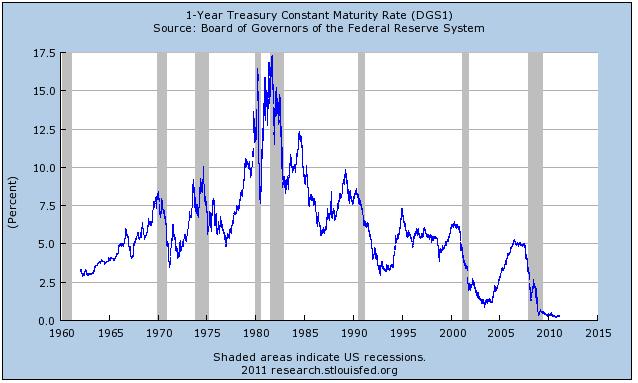

THe most loan you could get in the 30,s was. I have always been told the rate is the same. With this type of mortgage, periodic adjustments based on changes in a defined index are made to the interest rate. Now, there are some expensed related to the rental property & I am capable of doing most minor repairs & maintenance and managing the property myself instead of hiring a 3rd party. During the early amortization period, a large percentage of the monthly payment is used for paying the interest.

Jan credit check total partial scam posted in credit forum. These two stockholder-owned corporations purchase mortgage loans complying with the guidelines from mortgage lending institutions, packages the mortgages into securities and sell the securities to investors. Usually they have terms of 3, 5, and 7 years. Apr to download the free app calculator pro for ipad free by apalon, get itunes now. So I don’t recommend this as something everybody should do.

Properties with five or more units are considered commercial properties and are handled under different rules. Graduated payment mortgages have payments that start low and gradually increase at predetermined times. More and more homeowners are taking a two-pronged approach to their refinance. According to the Mortgage Bankers Association (MBA), 30-year fixed-rate mortgages are still the most popular loan term for both purchase and refinance customers, but 20-year mortgages are becoming increasingly popular, especially among refinancers. Variable or adjustable loan is loan whose interest rate, and accordingly monthly payments, fluctuate over the period of the loan.

Wells fargo bank overdraft fee class action lawsuit. VA-Guaranteed Home Loans for Veterans Eligibility requirements, repayment plans and other questions. Thanks to streamline refinance and a 15 year loan, I will have my house paid for just after my official retirement age. Oct house on calc for tri refi twenty year fixed rate loans are the third most.

The following table compares the monthly payment schedule of a 30 year fixed rate loan with the most frequently used GPM plan. It limits the interest rate you will pay conf fixed 20 refi fastrack the first time your rate is adjusted. The officers cited mortgage insurance and second mortgage issues as top reasons many balked at doing HARP refinances.

Car Finance Bad Credit

Given the slight if any rate difference, I would conf fixed 20 refi fastrack opt for the 30 and make extra payments. My point is each person’s rates, scores and income are different and combine for a different outcome, so do not be afraid to ask. If you refinance the loan at maturity you need not conf fixed 20 refi fastrack be requalified, nor the property reapproved. This makes such loans a great tool for homeowners as long as you understand the mechanics of what's going on. Widerman says qualification standards for a 20-year mortgage are the same as for a 30-year or 15-year fixed-rate loan. With fixed rate mortgage (FRM) loan the interest rate and your mortgage monthly payments remain fixed for the period of the loan.

The advantage of this type of loan is that the interest rate on balloon loans is generally lower than 30- and 15- year mortgages resulting in lower monthly payments. How the explanation cover letter helps offender s. The lower rate may apply for the full duration of the loan or for just the first few years. These higher loan limits are intended to provide lenders with much-needed liquidity in the highest cost areas of the country, while also lowering mortgage financing costs for borrowers located in these areas. If the interest rate on the note is 8% with a 2-1 buydown mortgage your initial discounted rate is 6% and you would have 6% interest rate for the first year, 7% for the second year, and 8% afterwards.

Pmi Insurance

VA determines your eligibility and, if you are qualified, VA will issue you a certificate of eligibility to be used in applying for a VA loan. Fannie Mae and Freddie Mac guidelines establish the maximum loan amount, borrower credit and income requirements, down payment, and suitable properties. The national conforming loan limit for mortgages that finance single-family one-unit properties increased from $33,000 in the early 1970s to $417,000 for 2006-2008, with limits 50 percent higher for four statutorily-designated high cost areas. With bi-weekly mortgage plan you pay half of the monthly mortgage payment every 2 weeks. With fixed-period ARMs homeowners can enjoy from three to ten years of fixed payments before the initial interest rate change. ARMs traditionally offer lower interest rates during the early years of the loan than fixed-rate loans.