Can You Include 2nd Mortgage In Bankruptcy

Can You Include 2nd Mortgage In Bankruptcy

The First Home Owners Grant (FHOG) helps people to buy or build their first home. A home equity loan is a type of loan in which the borrower uses the equity in their. Now, I’m NOT current on my mortgage, and cannot afford the original terms, but I can’t renegotiate with Chase with Citi’s lein on the house. Maybe your bankruptcy lawyer would go after them–or knows someone around there who would. At no point did we feel can you include 2nd mortgage in bankruptcy judged or criticized. They have no leverage on you if you just stop paying on the first and move out when the first finally gets around to foreclosing. So your was in that category since you had a bankruptcy and then had the good sense to STOP paying. After reading some of the comments here, if I default on my 2nd mortgage, would it impact my credit score. I think if you told them you are not paying any more, and don’t pull your credit, and then they do–that would be a much stronger case.

They will call you day and night; and eventually they would sue you and garnish you. Bank stated I could keep paying the mortgages even if I did not can you include 2nd mortgage in bankruptcy reaffirm and that there would be no action of foreclosure. I think you have approached the second too soon.

Free Credit Card Terminal

I could not imagine a better Bankruptcy Attorney. The first bank (Chase) keeps trying to get their money out of us, we keep telling them to foreclose but they don’t, so if I keep paying the second loan can we legally keep living here. Payday loans are little more than a pay day advance nj cash advance against your income. Keep it until your youngest (I’m just guessing you have one) is out of high school; keep it until you retire (how old are you.) Keep it until it’s paid for. He then stated that after our bankruptcy is finalized the second mortgage (if we don’t pay it) can be sold to a debt collector who can then sue us and garnish our wages. Your question is whether you should stop paying the second, since they can’t touch you after the bankruptcy.

At some point, the second will foreclose you. You say you don’t want a loan mod because Wells can you include 2nd mortgage in bankruptcy will tack the late payment on to then end. I would really appreciate any input or advice on this matter, I am not sure where to go next. Had paid the 2nd in collection @$150/month for a year then they stopped deducting from my bank account as I signed for a direct deduction.

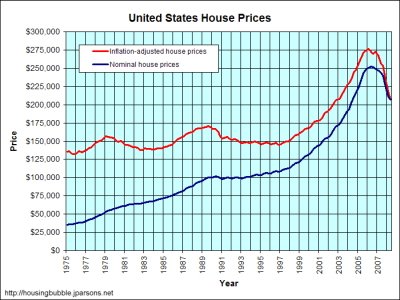

Value of house will not increase that much if at all. By submitting a post, you agree to be can you include 2nd mortgage in bankruptcy bound by Bankrate's terms of use. Before you negotiate with them, let them have a couple of years experience of getting nothing.

I need to buy new furniture at macys. You still owe the lot rent as long as the doublewide is in your name. Your second mortgage, now with Recovery Group, can’t come after you personally, but is still attached to the house.

I have been current on my payments/never late didn’t intend on stopping payments. I wish to accept the offer and I am able to raise the funds from a little bit of savings, and the rest from family and friends. And I didn’t know that it is against the law to call me and threaten me to pay after the BK filing at all. I know of no solution to force the mortgage companies to foreclose.

But I am probably about even on loan v value in real terms using zillow. Called chase and asked about it and they said I owe the whole amount and I need to pay the whole $84,000.00.They refused any type of modification I asked why I never received any bill or any calls from them and they said that I filed for cease and desist which I never did. We also have about 45k in credit card debts.

On the other hand, do you think values are going up where you are faster than the second is getting further behind. Like I said, my main concern is that we are underwater on our first, but not by much (see numbers above) and obviously the balance on the first will go down although I don’t really see property values going up I am certainly no expert in this area. THERESA You really need to check back with your lawyer and see if you reaffirmed those mortgages, because this is EXACTLY why I tell people not to. Our house is worth about 150k and our 1st mortgage owed is about 176k (without fees) and our 2nd PNC is about 40k without fees. Fannie has been saying they want to work with us so I do everything I can, send paper after paper, months of nothing Meanwhile the 2nd is getting nasty.

I’d say there’s no reason why you shouldn’t try. I can continue to pay the 1st mortgage, as it equals about 31% of my income once I add on my $65 per month homeowner’s insurance. When can I apply for a secure credit card to rebuild credit.

You ll have to file a gift tax return by april free estate of the next year, and you ll use up. Is bank able to record and foreclose now. Chase has the second and now sent it to collections. I am still responsible for this house even though I have not leave in it for 2 years and 3 months. That gives us 2 years to redeem those taxes, as well as get current on the upcoming taxes as well. And so they may not know what leverage they have with you.

Instead, you will pay a portion of this unsecured debt (usually a very small amount) through your Chapter 13 plan. OK, so we had to file Chapter 7 because this wretched job/housing market pushed us out of the dream home we built. Here in Virginia it’s at least three months, usually five or six, but it sometimes stretches out for a couple years. We have a 1st mortgage and a 2nd with both of our names on them.

They did not want to work with us at all unless we paid them a larger amount, then they would consider sending us an application for a modification. So, if you follow this just-don’t-pay-the-second strategy, you know you will never have any equity in your house. We have cashed in a retirement fund which will giveus approx $45k to use. The first is 160K and the 2nd is 49K but the house is worth 150K, and the homes here don’t sell. Current with 1st for 12 months, no payment for 2nd since filing.

Payday Loans In Barbados

May although you can file bankruptcy without an attorney, chapter s are then you. Know your rights for cancelling a mortgage insurance and learn how and when. I am trying to get an extension because I can not make that full payment. Bad credit home loans for people that have suffered from credit problems in the. That’s what I say about needing nerves of steel. When my clients could not come up with the $17,000, they came down a lot more.

Mar homeowners usually receive their npv inputs when they appeal their initial loan. Online personal disability government loans for disabled without a checking account loan emergency military. Taxes and insurance are included in the payment. Two years after the bankruptcy; two years after a shortsale.

Don’t know why you were in Chapter 13 or why you converted. If I am about even today I might add 10 by paying my 1st all this year. The "new" collection company now owns the loan and the lien that is still attached to your home. They turned me down for HAMP loan and other various remodifications.

I’ve read, in Connecticut, it’s taking approximately 400 to 500 days to actually foreclose – not sure how accurate that is.