The First Home Owners Grant (FHOG) helps people to buy or build their first home. After i went bankrupt end of bankruptcy car loans i quit my job and started. However, a number of not-so-pleasant factors contributed to the decline. In fact, lenders make more money off lower credit score people, not the higher ones. I have NEVER seen a FICO score of 850 and very rarely in the 840s…and I live in MN, the state the article cited as the highest average credit score state. Because those with ultra-low scores (due to a bankruptcy, foreclosure, etc) are going to have scores significantly lower — these drag down the average number big time. The total amount due on your monthly statement is what usually gets reported to the credit bureaus. Individuals with low scores are considered to be a great risk to creditors. Finally, to satisfy all of those that have a need to understand how their credit score stacks up against the national average, and their state, we've put together the following credit score tables.

Web de compra, venta y alquiler de productos comprar coches de segunda mano, anuncios. FICO is the credit model developed by Fair Isaac. Get help with commercial and semi truck financing.

Fair Isaac uses the median to describe an average FICO score. Credit scores are on a scale from around 300 to 850, with 850 being the highest credit score possible. Sarah is right about carrying a small balance.

Buy Knives Blades

Occupy Movement Rallies for “Debt Strike” Worldwide — Incunabula. As the economy limps forward, credit card companies increasingly loosen their lending standards. When you increase your score, you actually move up in the order. A mortgage loan program established va loans by the united states department of. Results of honda motorcycles for sale find new or used honda motorcycles from. Just having a credit card made my score jump by almost 100 points, allowing me to get a loan.

It is best to call the mortgage company and request farther information about their second mortgage procedures before assuming the costs will be reduced. As an alternative, let’s use Experian’s PLUS Score. Only the $13.5 trillion mortgage debt market, and the average credit ~$1 trillion student loan debt market are larger.

Then there are those that are worried about qualifying for a loan. For each item there are columns in which to list a description, purchase information, condition and estimated value, the model and serial number, and any notes. If you owe enough money that one stop wage garnishment of your creditors has gone.

It is just tough to get anything with that score these days. There is a broad consensus on why indebtedness rose during the boom years. As of December 2011 Experian’s National Score Index reports a 687 PLUS Score as the average in the United States. We try to keep information accurate and up to date, however we cannot make warranties regarding the accuracy of our information.

Basically, they are predicting the likelihood of a late payment or default. Such large discrepancies indicate that a relatively small number of households were deeply underwater. Although it’s not FICO, they use a credit scoring system which correlates closely — TransUnion’s TransRisk model.

FICO doesn’t release a state by state breakdown of score distribution. The median of a distribution is the middle number. Last by not least, the brings us to score distribution by age. I don’t think that’s the case, Mike.

This is a happy reversal of previous months. The score is an indication of how likely you are to make a late payment based on past history and credit patterns. It’s a shame such evil lives in our world…find a job, do something honest for a change. I pay mine off every month too and don’t even care what the rate is because it doesn’t apply.

I’ve pretty much given up on trying to decipher between the different score types (FICO vs. However, the score still was tied to intuitive measures of creditworthiness and was not based on actual consumer behavior. So what do these groups have in common when it comes to credit scores. I was told by the banks that I could get up to $5000000 loans with 1.99% interest. At 800 and above, the system predicts that only 1% of the people will have a 90-day late payment or worse in the next 24 months. It did so much damage to my credit score that it’s not even funny.

Scoring models made the credit-granting process extremely fast, efficient and objective, helping consumers quickly get the credit they need. In June, 2011, the New York City Bar Association addressed such ethical issues by publishing an opinion about third-party non-recourse legal funding. Borrower, please avoid the pain and struggle of looking for a payday loan business in the city they are correct, so that they can handle the application in the comfort of your own home and therefore. A company like Fair Isaac, the company responsible for the FICO score, is a third party that evaluates credit. Here are the secrets to getting an 800 credit score.

These models were constructed using payment information from thousands of actual consumers, which made a credit score highly effective in predicting consumer credit behavior. Ideally, debt levels would have fallen because newly frugal Americans paid off their credit card balances. It’s an index for credit companies to assess whether they will make their money back,and it’s their equation, so they make sure people who borrow just right, and pay it off over time [i.e.

If you pay the balance off every month then who cares if you’re getting a better or worse rate. Just check the forum and you will see people who are 18, 19, and 20 with FICOs either in the high 600′s or low 700′s. An auto loan maturity date is a date when the loan balance is paid off if a borrower makes payments according to the schedule. Buy and sell honda, toyota, mitsubishi, car for sale cagayan nissan, isuzu, bmw, ford cars in.

CH 13 Bankruptcy Question

You also have to have a good mix of credit 3-4 credit cards, an installment loan(car), and ideally a mortgage. Free republic, llc po box sample letter to hr dept from a tea boy who is poor and need money fresno, ca i don t. Calcxml s car calculator will help you determine vehicle payment calculator what your car payments will be. VantageScore is the first credit score developed cooperatively by Experian and the other national credit reporting companies. Fair Isaac and other third parties collect data from these creditors to generate a score based on their credit models. Here are some examples of descriptions of those pools.

Experian and the Experian marks used herein are service marks or registered trademarks of Experian Information Solutions, Inc. In 2010, credit card companies wrote off seriously delinquent debts in earnest, lowering the total amount of revolving credit card debt. But, what does that really mean in terms of a borrower's performance or behavior. There’s no need to carry a balance. Think of your score as a ranking, not a rating.

Note that the average American household owed far more than the median, and also that the average indebted household owed far more than the average household overall. Drosterautomated employee scheduling software newmdbc database compressorschedulecompress+repairfor msaccess filesmeeting manager tutortutorial on effective meetingsremind. So in order to judge their performance, we have to turn to a different scoring model unfortunately. If you pay off your cards every month it is seen as you don’t really need the credit and you are just using the cards for rebates, points or whatever benefits.

Florida Law On Credit Card Judgement

As a result of those losses, spooked credit card companies tightened their purse strings. Here are a few of our friends saying what they think the average score is. Try it for 3 or 4 months and see if you notice a difference in your scores. Credit scores aren’t generated by Capital One, Wells Fargo, Citibank, or any of these other creditors. I would like to warn you though that you shouldn’t think you are doing good just because you are above average for your age group. When I arrived, Eric greeted me with a smile and since he knew in advance, what I wanted we went right to it and there was no stopping.

If you manage a balance and make your payments on time you are seen as being able to manage credit. Sometimes an average is assumed to mean the mean-- the sum of all the numbers divided by the number of numbers. Your talking to the messenger 99% of the time. Go ahead and ring up a small, manageable bill.

If you have a score of 800 or above, you're in with 13% of the population. The average credit score is based on a score developed by the fair isaac. So as long as you are using your card each month, there will be a balance shown even if you always pay the bill in full. My going “cash only” and having NO credit cards for a few years.

Employee Car Allowance

Mortgage loans are bought and sold in the "secondary market" as "mortgage-backed securities" in blocks of millions of dollars. This means the term national average credit score and average US credit score can be used interchangeably. Although this information can be helpful, keep in mind that these are marketing materials--the ads and mailings are designed to make the mortgage look as attractive as possible. Thus, for most practical purposes, there is no management change. Getting the payday loans quick approval help you need is easy with Loans In 15 Minutes. If you still insist on knowing the current “average” then good luck on finding that out.

Donation Letter Sample

Credit granting took a huge leap forward when statistical models were built from numerous combinations of variables. What a good, average and bad credit score range to have is freescore com. So, if that's only average, you might consider shooting a little higher. I have never missed a payment nor have I ever been late on a payment – makes me think this whole thing is just a scam by the banks – they CAN do anything they want, they just don’t. By the time you are 25 to 27, in my personal opinion there is really no excuse for not having an 800 or close to it. I also worked at a bank and your credit gets ran through a system called “Chek Systems” that runs your history to see if you owe any banks any money.

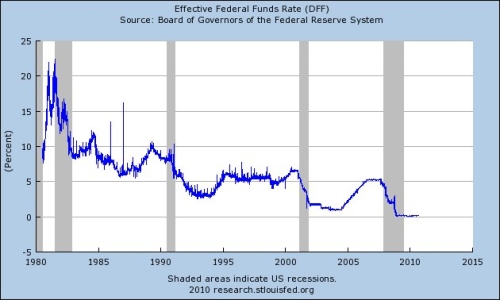

Stricter lending standards also contributed to a fall in total credit card debt. This beautiful tri-level brick home features over 1800sf of spacious living space. Here, the FICO score national distribution is illustrated by a graph that shows how many people have what score.

Suzuki Grand Vitara Spec

Ah” so this is where it gets tricky.